28+ Loan amounts based on income

Refinancing your existing loan. Actual rate and available repayment terms will vary based on your income.

Expense Budget Templates 15 Free Ms Xlsx Pdf Docs Budget Template Budgeting Templates

Repayment terms range from two to seven years making SoFi an incredibly flexible option for those with sufficient credit minimum 650.

. A VA loan is a mortgage loan in the United States guaranteed by the United States Department of Veterans Affairs VA. Personal loan amounts are from 1000 to 100000 and theyre typically repaid over a term of. You may have to pay the AMT if your taxable income for regular tax purposes plus any adjustments and preference items that apply to you are more than the AMT exemption amount.

3000 for student loan interest paid and 10000 for alimony paid your adjusted gross income is 70000. Availed only in the year of expense. In Q3 2020 mortgage lenders had a per-loan expense of 7452.

This article will look at the subsidy amounts by income for the the Affordable Care Act. Jane Doe age 28 and unmarried enrolled. The following table shows the required income needed to have a 28 DTI front end ratio on a home purchase with 20 down for various home values.

Income received via the Centrelink PLS reverse mortgage may be reduced or ceased in the future if the value of your home drops. Tax brackets are based on taxable income after all deductions and credits and not gross income or adjusted gross income. If approved funds will be loaded on a prepaid card and the loan amount will be deducted from your tax refund reducing the amount paid directly to you.

Since 2008 most quarters have seen a net production income of between 25 and 75 basis points. Here are four steps to record loan and loan repayment in your accounts. For the sake of this calculation a 30-year fixed-rate home loan is presumed with a rate at 5 APR.

The loan has to be taken for construction and has to be completed within 5 years. 150 Lakh and Interest Deduction under section 24 of up to Rs. The program is for American veterans military members currently serving in the US.

Home loan entitles Individuals to Deduction Under Section 80C of up to Rs. An FHA loan is a mortgage issued by federally qualified lenders and insured by the Federal Housing Administration FHA. Payments are capped at 10 of discretionary income if you received loan money after July 1 2014 and 15 if you received loan money before then.

Your maximum loan amount may vary depending on your loan purpose income and creditworthiness. Loan amounts available may vary by the state you live in. Student loan interest deduction.

Example Required Income Levels at Various Home Loan Amounts. Articles deals with Faqs on Benefit Us. If approved funds will be loaded on a prepaid card and the loan amount will be deducted from your tax refund reducing the amount paid directly to you.

The AMT exemption amounts are set by law for each filing status. Individual amounts are dependent on whether applicants receive a full or part pension. Maximum allowable income is 115 of local median income.

FHA loans are designed for low-to. 178 percent to 199 percent for. 24 and 80C on Jointly Owned Property Under Construction Property multiple properties and Simultaneous benefit of Interest exemption and HRA.

Stamp value of the property under INR 45 lakh. When recording your loan and loan repayment in your general ledger your business will enter a debit to the cash account to record the receipt of cash from the loan and a credit to a loan liability account for the outstanding loan. The Affordable Care Act Obamacare is a way to help lower-income individuals and individuals without health care afford health care.

For tax year 2010 Congress raised the AMT exemption amounts to the following levels. For 2021 the amount of your student loan interest deduction is gradually reduced phased out if your MAGI is between 70000 and 85000 140000 and 170000 if you file a joint return. Federal tax tables list how much you will need to pay on your taxable income at various earning levels.

See how using your Household Capital could improve your retirement income. Approval and loan amount based on expected refund amount eligibility criteria and underwriting. Loans are offered in amounts of 250 500 750 1250 or 3500.

Approval and loan amount based on expected refund amount eligibility criteria and underwriting. How Expensive is it to Originate Mortgages. You are eligible for loan forgiveness after 20 or 25 years depending on when you borrowed the money.

About 68 of alcohol-related fatalities happen at night and 28 happen during the daytime based on NHTSA data. Loans have a relatively small funding fee. Military reservists and select surviving spouses provided they do not remarry and can be used to purchase single-family homes condominiums multi-unit properties.

Each veteran is considered based on a variety of factors. The range of loan amounts that a lender will service. Both BAH and BAS are counted as income to help borrwers qualify.

Fixed rates range from 347 APR to 1349 APR excludes 025 Auto Pay discount. This is up from 7217 in the same quarter of 2019. Approvals above 41 require an explanation.

10000 IBR Loan with a 7 gross income payment percentage for a Senior student making 65000 annually throughout the life of the loan. In either case the lender may contract for and receive a loan finance charge based on the aggregate principal resulting from the consolidation at a rate not in excess of that permitted by the provisions on loan finance charge for consumer loans Section 37-3-201 or the provisions on loan finance charge for supervised loans Section 37-3-508. Try our equity calculator or call us on 1300 622 100.

Refunds received after 2021 but before your income tax return is filed. Your maximum loan amount may vary depending on your loan purpose income and creditworthiness. Im a supporter of ACA despite the.

The loan amount must be under 35 lakhs and the property value under 50 lakhs. Although health care is still extremely expensive the Affordable Care Act provides subsidies. Record the Initial Loan Transaction.

PLUS grads parents 6. Loans are offered in amounts of 250 500 750 1250 or 3500.

Payslip Templates 28 Free Printable Excel Word Formats Templates Excel Words

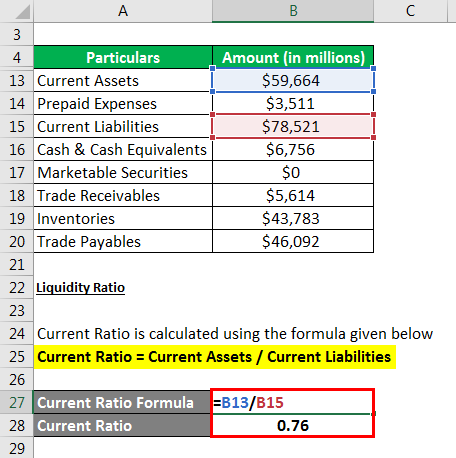

Accounting Ratio Formula Complete Guide On Accounting Ratio Formula

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Calculator

How Old Is Too Old To Be Living With Parents Gen Z Says Age 28 Would Be Embarrassing Business Wire

Sample Expenditure Budget Budget Template Budget Template Free Budget Template Printable

28 Sample Income And Expense Statements In Pdf Ms Word

Sec Filing Crossfirst Bankshares Inc

Sales Forecast Templates 15 Free Ms Docs Xlsx Pdf Templates Excel Templates Forecast

Financial Planner Finance Binder 28 Page Digital Download Suzydarlen Com

Colorado Appraisal Continuing Education License Renewal Mckissock Learning

Template Net 8 Expenditure Budget Templates Free Sample Example Format Ebfc7ad6 Resumesample R Budget Template Budget Template Free Budget Template Printable

Business Proposal 28 Free Pdf Word Psd Documents Download Free Premium Templates

Total Debt Service Ratio Explanation And Examples With Excel Template

28 Ways To Save Money Each Month Hanfincal Com

Total Debt Service Ratio Explanation And Examples With Excel Template

Salary Slip Templates 19 Free Printable Ms Docs Xlsx Formats Samples Examples Salary Excel Templates Payroll Template

2